Welcome to the wild world of buy now, pay later (BNPL) services, where instant gratification meets the reality of future payments. These services have taken the shopping world by storm, offering a tempting way to snag that must-have item without the immediate financial sting. But beware, this financial adventure comes with its own set of pros and cons. Let's dive in and explore the most popular BNPL services, their history, and what makes them both a blessing and a potential curse.

A Brief History of BNPL

The concept of BNPL isn't new. It dates back to the 1840s, when installment plans emerged as a way for consumers to purchase expensive goods like furniture and pianos without having the funds upfront. Department stores like Nordstrom started issuing private-label credit cards in the 1980s and 90s, paving the way for modern BNPL services.

The real game-changer came with the rise of fintech startups in the early 2010s. Companies like Affirm (2012) and Afterpay (2014) revolutionized the space by integrating installment plans into online shopping. Klarna followed suit in the US in 2015, and Sezzle joined the fray in 2016. The COVID-19 pandemic further accelerated the popularity of BNPL services as consumers sought flexible payment options during uncertain times.

Popular BNPL Services

- Affirm: Known for its flexibility, Affirm offers interest-free installment plans for purchases ranging from $250 to $25,000. It partners with thousands of merchants, including big names like Amazon and Peloton. Affirm also provides transparency in its terms, allowing consumers to see the total cost upfront without hidden fees.

- Afterpay: This service splits your purchase into four equal payments, due every two weeks. It's perfect for those who want to spread out payments without interest, but watch out for late fees if you miss a payment. Afterpay's user-friendly app provides reminders and a clear payment schedule, making it easy to keep track of your spending.

- Klarna: With a variety of payment options, Klarna allows you to pay in four installments or even defer payments for up to 30 days. It's a favorite among fashion-forward shoppers and tech enthusiasts alike. Klarna also offers a "Pay Later" option, allowing users to try items before committing to a purchase.

- Sezzle: Similar to Afterpay, Sezzle divides your purchase into four interest-free payments. It's a great option for budget-conscious shoppers who want to avoid credit card debt. Sezzle's focus on financial education and empowerment sets it apart, providing resources to help users manage their finances effectively.

- Zip (formerly Quadpay): Zip offers four biweekly payments with no interest, making it easy to manage larger purchases. It's a popular choice for those who want to break down big-ticket items into manageable chunks. Zip's integration with numerous online and in-store retailers provides versatility and convenience.

Pros of BNPL Services

- No Interest: Many BNPL services offer interest-free installment plans, making it easier to manage payments without accruing debt. This can be especially beneficial for those who prefer not to use credit cards or incur high-interest charges.

- Immediate Ownership: Unlike traditional layaway plans, BNPL services allow you to take home your purchase immediately and pay for it over time. This instant gratification can be a game-changer for those who need or want an item right away.

- No Credit Check: Most BNPL services don't require a credit check, making them accessible to a wider range of consumers. This can be a great option for those with limited or poor credit history.

- Budget-Friendly: By spreading out payments, BNPL services can help you budget more effectively and avoid large upfront costs. This can make it easier to manage your finances and plan for future expenses.

- Convenience: With easy-to-use apps and seamless integration with online retailers, BNPL services make shopping more convenient and flexible. The ability to manage payments and track spending from your smartphone adds a layer of convenience that traditional payment methods can't match.

Cons of BNPL Services

- Late Fees: While interest-free, missing a payment can result in hefty late fees, which can quickly add up. These fees can negate the benefits of using BNPL services if you're not careful with your payment schedule.

- Debt Spiral: The ease of using BNPL services can lead to impulsive buying and accumulating debt if not managed carefully. It's important to remain mindful of your spending habits and avoid overextending yourself.

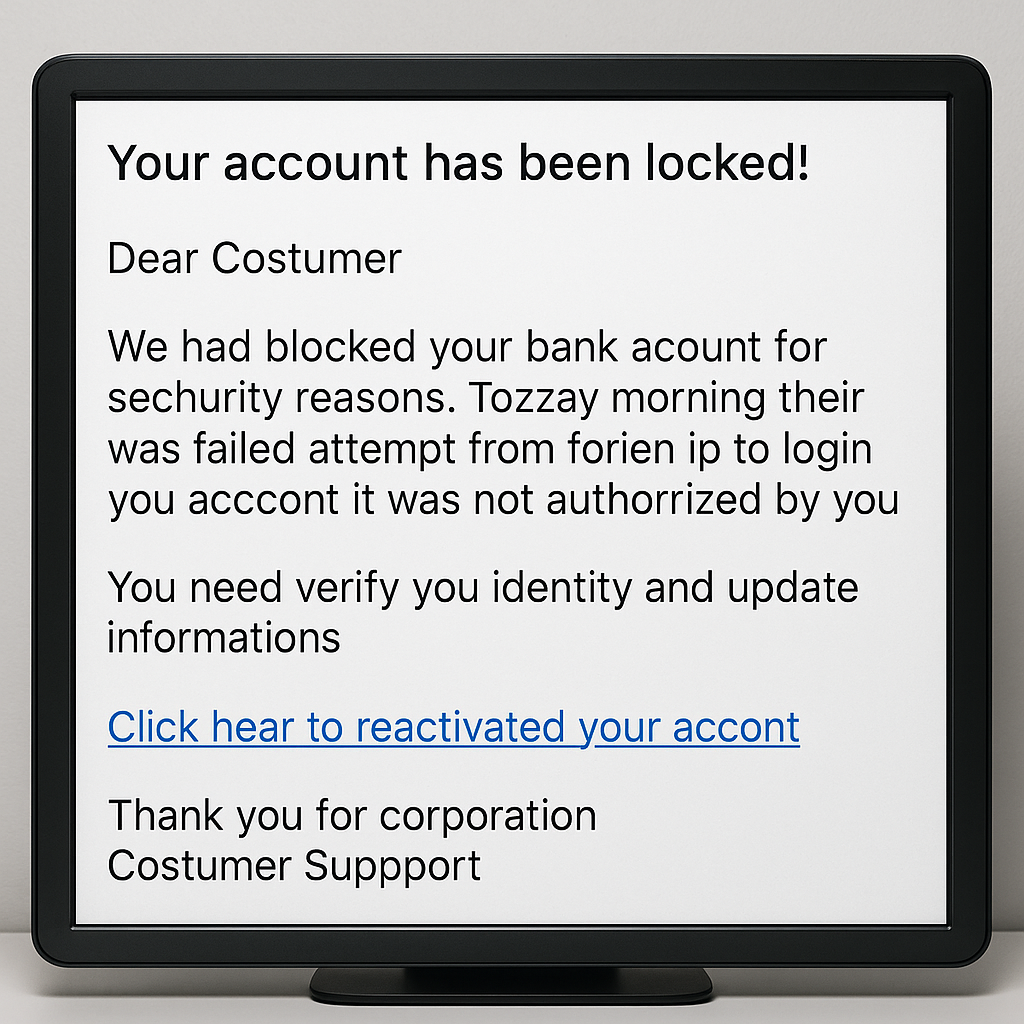

- Hidden Fees: Some services may have hidden fees or charges that can catch you off guard if you're not paying close attention to the terms. Always read the fine print and understand the total cost before committing to a BNPL plan.

- Credit Impact: Although many BNPL services don't require a credit check, some may report missed payments to credit bureaus, potentially affecting your credit score. It's crucial to make timely payments to avoid any negative impact on your credit.

- Overuse: The convenience of BNPL services can lead to overuse, making it harder to keep track of multiple payments and manage finances effectively. It's essential to use these services responsibly and maintain a clear overview of your financial obligations.

BNPL services can be a fantastic tool for managing your finances and making larger purchases more manageable. However, like any financial tool, they come with their own set of risks and challenges. The key is to use them wisely, stay on top of your payments, and avoid the temptation to overspend. Happy shopping, and may your financial journey be both prosperous and amusing!