Ah, the world of budgeting—where dreams of financial freedom and reality often clash in an epic battle of wits and numbers. Enter the financial budgeting app, a modern-day hero armed with charts, graphs, and reminders. But is it all rainbows and dollar signs, or are there hidden quirks in this digital adventure? Let’s explore the pros and cons of using a financial budgeting app with a sprinkle of humor!

Pros

The All-Seeing Eye of Your Finances

Financial budgeting apps are like having a personal financial Gandalf. They see all, know all, and guide you on your journey to financial wisdom. No more wondering where that $50 went; your app will reveal that it was spent on 10 lattes.

Detailed Insight: Most apps offer detailed insights into your spending patterns, allowing you to identify wasteful habits and make more informed financial decisions. It's like having an accountant who never judges your impulse purchases.

Instant Gratification

With a swipe and a tap, you can instantly see your budget status. It’s like having a magical mirror that tells you whether you’re the fairest spender of them all or a budget-busting beast. Spoiler: it’s probably those impulse buys.

Visual Appeal: Many apps come with sleek, user-friendly interfaces and visual charts that make tracking your finances feel less like a chore and more like a game. Watching your savings grow can be oddly satisfying.

Goal Setting Made Fun

Setting financial goals has never been more gamified! Want to save for a vacation? Your app will cheer you on with motivational notifications. It’s like having a financial coach who also moonlights as a cheerleader. Go, team savings!

Milestones and Rewards: Some apps offer milestones and rewards for reaching your financial goals, turning the journey into an exciting challenge. Who knew budgeting could feel like leveling up in a video game?

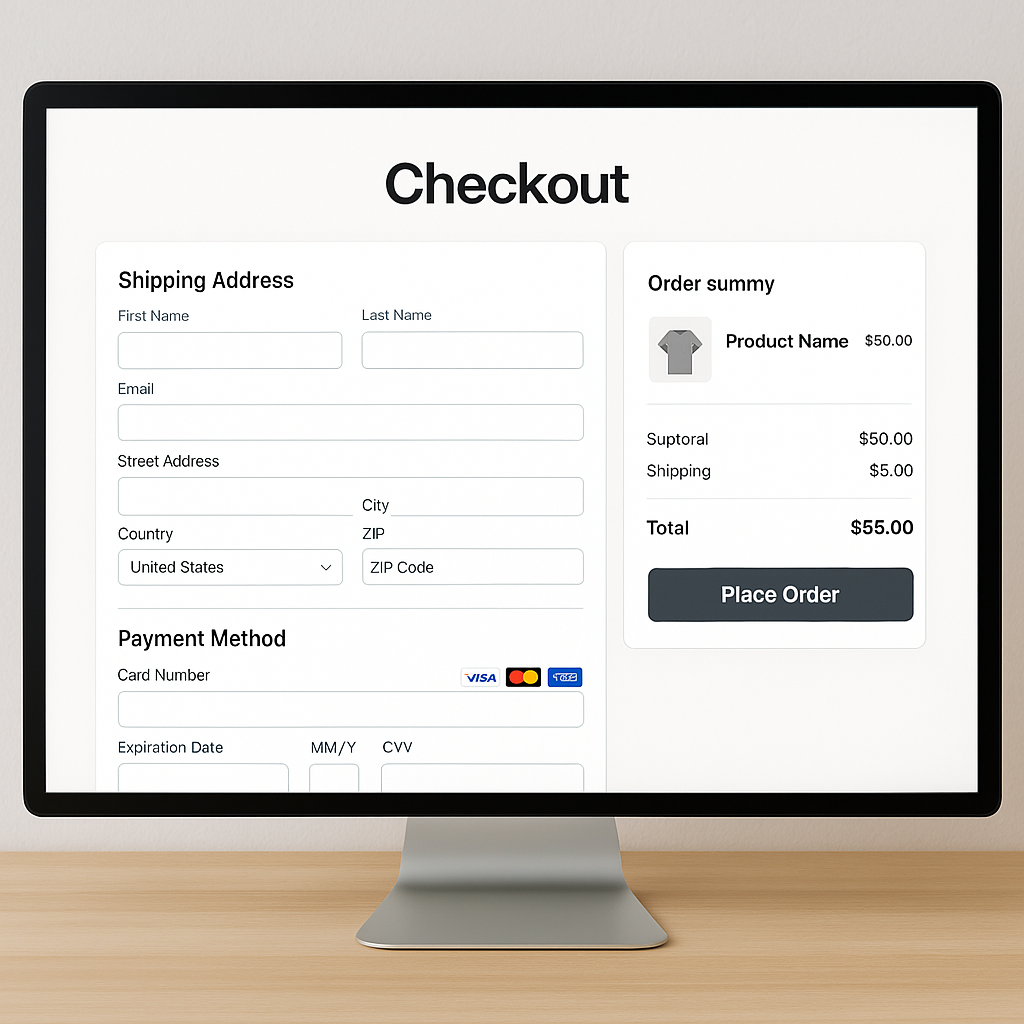

Automated Tracking

Say goodbye to the dreaded manual expense tracking. Your app will automatically categorize your spending, making it easier than ever to see where your money is going. It’s like having a financial assistant who never takes a coffee break (or asks for a raise).

Synchronization: Many budgeting apps sync with your bank accounts and credit cards, ensuring that your transactions are always up-to-date. This seamless integration saves you time and effort in keeping your budget current.

Budgeting Buddy

Need some accountability? Some apps allow you to share your budget with a partner or friend. Now you can both cringe together over that unexpected shopping spree. Misery loves company, after all!

Collaborative Features: Collaborative budgeting can help couples or roommates manage shared expenses more effectively, fostering better communication and financial harmony.

Cons

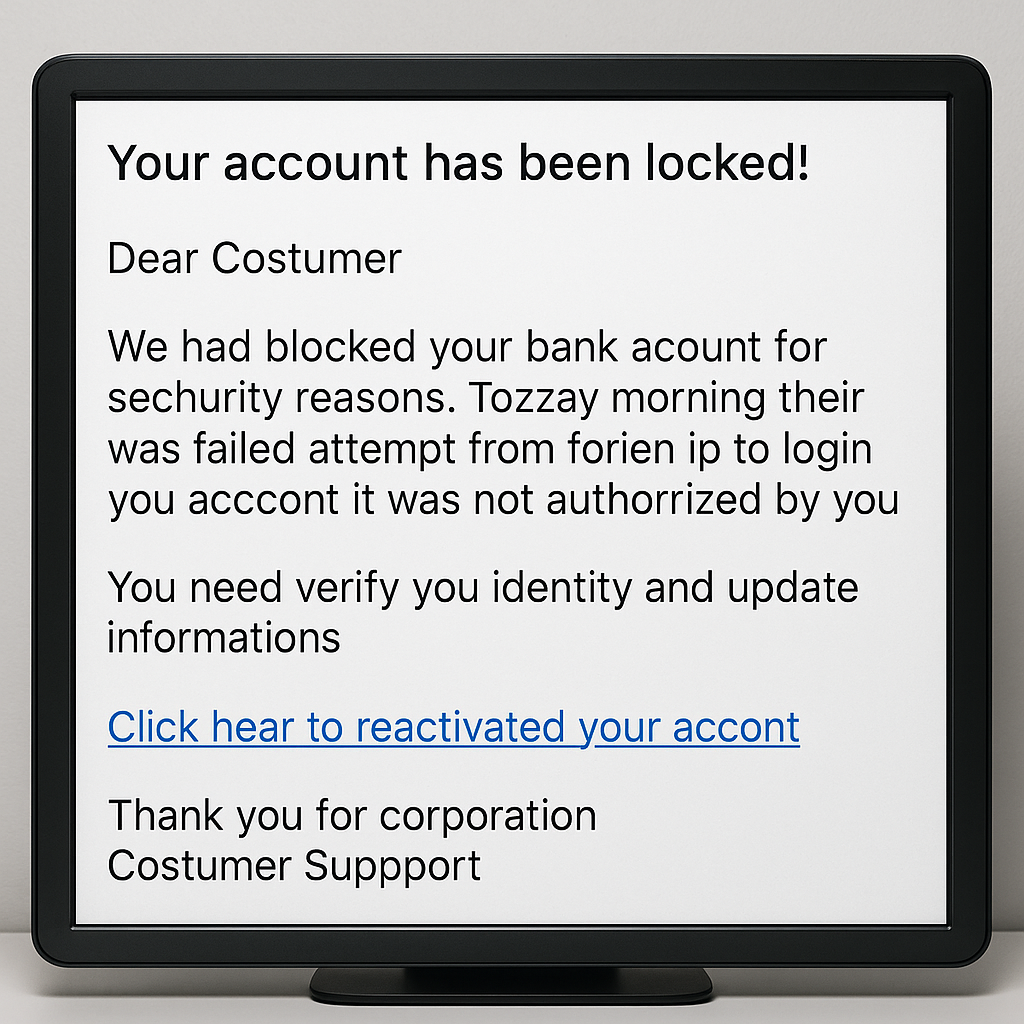

Too Much Truth

The brutal honesty of a budgeting app can be a bit... harsh. It will reveal every penny spent on late-night fast food runs and forgotten subscriptions. Prepare for some tough love as your financial habits are laid bare.

Reality Check: While it's beneficial to know where your money goes, it can also be a sobering experience. Be prepared for some eye-opening revelations about your spending behavior.

Notification Overload

Do you love notifications? No? Well, too bad. Your budgeting app will bombard you with alerts, reminders, and updates. It’s like having a very persistent, slightly annoying financial advisor who never takes a hint.

Customization: The good news is that most apps allow you to customize notification settings, so you can choose how often you want to be reminded of your financial goals and spending limits.

Setup Woes

Setting up your budgeting app can feel like navigating a digital labyrinth. Linking accounts, categorizing expenses, and setting up goals can be a time-consuming process. You might need a cup of tea and a deep breath (or ten) to get through it.

Initial Investment: The initial setup may be daunting, but once it's done, the app can save you a lot of time and effort in the long run. Patience pays off!

Tech Glitches

Apps are great until they decide to have a meltdown. Glitches, crashes, and syncing issues can make you want to throw your phone out the window. Just remember, the app is supposed to help you save money, not cost you a new phone.

Tech Support: Most reputable apps offer customer support and frequent updates to address bugs and improve functionality. Don't hesitate to reach out if you encounter technical issues.

Privacy Concerns

Handing over your financial data to an app can be a bit unsettling. While most apps use robust security measures, the thought of your spending habits being out there in the digital ether can be a tad unnerving. Just make sure to choose a reputable app and read those privacy policies.

Security Features: Look for apps with strong encryption, two-factor authentication, and transparent privacy policies. Your financial data should be protected with the highest security standards.

In the end, a financial budgeting app can be a powerful tool in your quest for financial enlightenment—if you’re willing to embrace its quirks and occasional overzealous notifications. So, arm yourself with digital courage, and may your budgeting journey be both prosperous and amusing!